Browse Our Website

Explore our website to discover the full range of banking services and solutions we offer. Take your time to learn about our products, features, and how we can help you meet your financial goals.

Explore our website to discover the full range of banking services and solutions we offer. Take your time to learn about our products, features, and how we can help you meet your financial goals.

Sign up for an account by providing your basic details. The registration process is quick, and once completed, you’ll have access to a wide range of banking services tailored to your needs.

To ensure your security, we’ll send a verification email to confirm your account registration. Simply click the link in the email to verify your identity and continue with the account setup process.

For added security and to comply with regulatory standards, we require you to update your Know Your Customer (KYC) details. This involves submitting necessary identification and proof of address, ensuring your account is fully verified and secure.

Once your account is set up, you're ready to start using our banking services. Transfer funds, pay bills, apply for loans, and more with just a few clicks—it's all at your fingertips, whenever you need it.

Our deposit services offer you a secure and flexible way to manage your savings. Whether you’re looking to set aside funds for short-term goals or build long-term wealth, our deposit options provide competitive interest rates and easy access to your funds. Start your journey towards financial security today with our trusted deposit solutions.

Our Deposit Protection Scheme (DPS) ensures that your hard-earned savings are protected. Under this scheme, deposits up to a certain amount are guaranteed against unforeseen events, giving you peace of mind and confidence in our banking services. Trust us to safeguard your future.

Grow your savings with our Fixed Deposit Receipt (FDR) service. Lock in your funds for a set period and earn a higher interest rate than regular savings accounts. Our FDR options are tailored to meet your financial goals, whether you're looking for short-term gains or long-term growth. Secure, reliable, and rewarding.

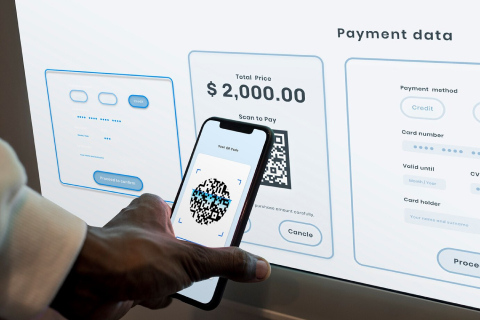

Easily manage your financial activities with our seamless transaction services. From making payments to transferring funds between accounts, our secure online and mobile banking platforms ensure quick, reliable, and hassle-free transactions. Experience the convenience of banking at your fingertips.

Access your money whenever you need it with our straightforward withdrawal options. Whether you need cash from an ATM, want to transfer funds to another account, or wish to withdraw from your deposit, our process is quick and secure. Your funds, your control.

Earn rewards by referring friends, family, or colleagues to our banking services! Our referral program allows you to share the benefits of our trusted financial solutions while enjoying exclusive bonuses for every successful referral. Start referring today and enjoy the perks of being part of our community.

If you have an issue with a product you bought – maybe it hasn’t arrived or you received the wrong item – please contact the retailer.

If your ATM card will not work, it is probably because the bank's verification system is not operational. You may consider other options, such as cashing a check in your immediate area or using a credit card.

The data you share will include the following: · account details such as the balance and name on the account. · regular payment details, such as who you’re paying, Direct Debits, and standing orders · transactions such as incoming and outgoing payments from your current account. You should only share the minimum amount of data needed to access the product or service you want to use. You’ll never be asked to share your bank login details or password to anyone other than your own bank or building society.

No – online banking is free. However, some regulated apps and websites may choose to charge you for their products and services.

No. You’ll only use online banking if you give your explicit consent to a regulated app or website. It’s always your choice.

A growing number of energy and water providers use the banking data to help assess a customer’s ability to pay their bill, and in some cases, move them on to a more affordable tariff.

For example, if a customer calls the energy company, and is eligible to go on the banking journey, the team can send out a secure link which allows it to see a snapshot of the customer’s banking data at that specific time. This can enable an immediate switch to the lower tariff while they are on the phone.

The company should then delete the data.